The MMXM Traders – NQ Mastery Course 2025: A Focused Path to Professional NQ Trading

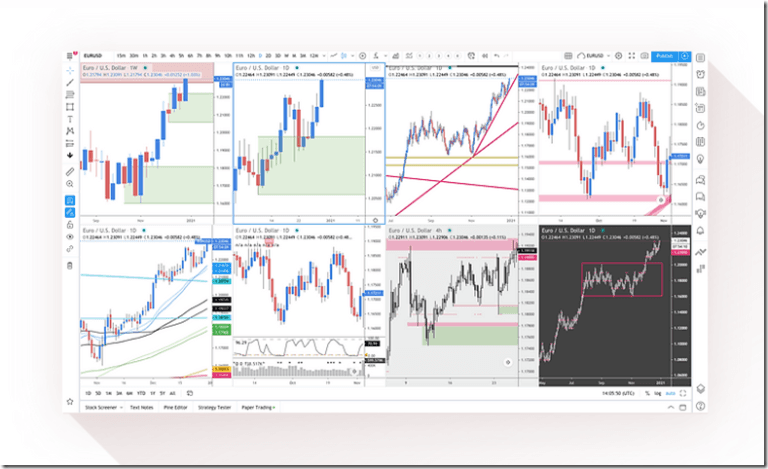

The MMXM Traders – NQ Mastery Course 2025 positions itself as a targeted program for serious traders. The landing page highlights a concise set of pillars designed to sharpen decision making and execution. The curriculum centers on advanced concepts, a top‑down market approach, daily bias formation, private scalping models, and prop firm risk management. Each pillar aims to build a repeatable edge in the Nasdaq futures arena.

What Stands Out at First Glance

The page wastes no space on fluff. Instead, it spotlights the five elements you will study and apply. This clarity helps traders understand exactly what they are buying. It also signals a practical, market‑facing focus over generic theory. Therefore, you know the emphasis before you enroll.

Advanced Concepts: Build Context Before Tactics

The curriculum begins with advanced concepts to establish a high‑level lens. This focus suggests you will learn the underlying mechanics that drive price. Context informs execution in fast markets like NQ. A deeper mental model helps you avoid chasing noise and late moves. Consequently, you approach setups with greater conviction and restraint.

Top‑Down Approach: Anchor Every Trade to the Bigger Picture

The top‑down approach encourages analysis from higher timeframes to lower. You align intraday tactics to broader structure and liquidity. This discipline filters weak ideas and prioritizes asymmetric opportunities. It also reduces overtrading during chop. The landing page lists this pillar to signal structured analysis as a core habit.

How to Achieve Daily Bias: Turn Data Into Direction

Daily bias formation is explicitly promised on the page. This skill helps you decide whether to favor longs, shorts, or neutrality. A clear bias guides entry selection, scaling, and invalidation. It also improves emotional control by narrowing choices. The curriculum’s inclusion of daily bias suggests a rules‑based process for direction and risk.

Private Scalping Models: Precision Entries for Fast Markets

Scalping models appear as a private, named component. This signals proprietary or refined entry frameworks. NQ rewards timing and velocity, so modeling matters. Repeatable triggers and management rules compress the learning curve. The curriculum’s emphasis points to tactical execution that complements higher‑timeframe context.

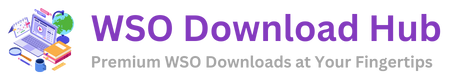

Prop Firm Risk Management: Trade to Keep the Seat

Prop firm constraints differ from personal accounts. The page calls out prop firm risk management directly. This implies rules for drawdown protection, scaling, and discipline. It also suggests tactics to pass evaluations and maintain accounts. Including this pillar highlights practical survival skills for funded traders.

How These Pillars Likely Fit Together

Although the page is brief, the sequence is logical. You begin with advanced concepts for context. Then you apply a top‑down approach for structure. Next, you define a daily bias to choose your lane. You execute with private scalping models for entries and exits. Finally, you protect capital with prop firm risk frameworks. Together, these pieces form a full trading stack.

Who The MMXM Traders – NQ Mastery Course 2025 Is Best For

The landing page speaks to traders seeking structure and clarity. If you want a defined process to build bias and execute precisely, it fits. If you need guidance tailored to funded account rules, it also aligns well. The concise focus suggests a preference for practice over theory. Therefore, motivated traders who value process will likely benefit most.

Strengths You Can Infer From the Page

- Clear promise of daily bias formation and execution structure

- Emphasis on proprietary scalping models for fast markets

- Direct attention to prop firm risk realities and rules

- A top‑down methodology that reduces randomness These elements support a professional approach to NQ trading.

What to Expect in Day‑to‑Day Use

Expect to start each session with a top‑down read. Then set a daily bias with clear invalidation. Wait for triggers from your scalping models. Manage risk with prop firm constraints in mind. The landing page points to this disciplined rhythm as the core workflow. As a result, your playbook becomes consistent and testable.

Final Verdict: A Tight Curriculum With Practical Aims

The MMXM Traders – NQ Mastery Course 2025 presents a compact yet robust framework. Its five pillars cover context, structure, bias, execution, and risk. The focus feels tailored to serious intraday traders and funded accounts. If you want a process that turns analysis into action, this page delivers a clear promise. The ultimate value will come from applying each pillar as a single, cohesive system.

Next Step: Complement Your Edge With Hidden Signal Mastery

If you want to bolster your setup selection and see more A‑grade entries, explore Simpler Trading – Stop Missing Hidden Trades Elite. It pairs well with The MMXM Traders – NQ Mastery Course 2025 by sharpening your ability to spot and act on high‑probability opportunities you might otherwise miss.

Sales Page

Download Link for VIP Membership Users:

Download link is available for Lifetime VIP Membership members only. |

|---|

![AI Blast – MAKE $20 Every HOUR With AI [LONGTERM PASSIVE METHOD]](https://wsodownloadhub.com/wp-content/uploads/2024/11/AI-Blast-–-MAKE-20-Every-HOUR-With-AI-LONGTERM-PASSIVE-METHOD-.png)